Top News On Picking Credit Card Apps

Wiki Article

How Do I Check To Determine If My Credit Card Were Reported Stolen?

To determine whether your credit/debit card has been reported stolen in the USA Follow these steps: Contact Your Credit Card Issuer-

Contact the customer support phone number located on the back of your credit card.

Tell the representative you have a problem with your card or stolen and you want to verify its authenticity.

Be prepared to supply your personal information and credit card details for verification for verification purposes.

Check Your Online Account

Login to your account online for credit cards or for banking.

You can check for notifications, alerts and messages regarding the status your credit card.

Examine recent transactions to determine any suspicious or unauthorised activities that are suspicious or illegal.

Keep an eye on Your Credit Report

Obtain a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, TransUnion) through AnnualCreditReport.com.

Check the report for suspicious credit accounts or inquiries that might indicate suspicious activity.

Fraud Alerts (and Security Freezes)

If you suspect identity theft or fraud, place a fraud freeze or alert on your credit file.

A fraud alert will inform creditors that they need to make extra efforts to verify your identity before extending credit. But the credit freeze can limit access to your credit report.

Keep an eye on the situation and report any suspicious Activity

Check your credit card statements frequently, and notify the card issuer of any unauthorised or suspicious transactions.

Report suspected identity theft and fraud to the Federal Trade Commission. Also make a complaint to the local police department.

By contacting the issuer of your credit cards, examining your account's activity on your website, monitoring your account and looking out for any indicators of unauthorized activities, proactive steps can be taken to guard yourself from credit fraud and to resolve any potential issues relating to a stolen credit.

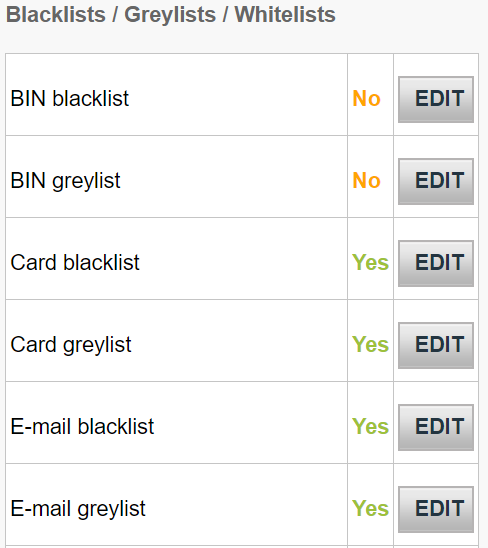

What Should I Do If My Credit Card Appears On A "Blacklist"?

Follow these steps if you suspect your credit card is on"blacklists "blacklist" or you suspect fraudulent activity with the card: Call the credit card issuer right away-

You can call the customer service phone number located on the back of your card. Or you can go to the website to see the number for reporting fraud.

Inform the bank that issued your card of the concerns you have. Declare that you believe that there was a fraud on your card, or the card could be compromised.

Report Suspicious Activity-

You must explain any transaction that you consider to be unusual or unauthorised on your card statement.

Give specific information about the transaction in question such as dates, amount, and merchant names If you have them.

Request Card Replacement, Blocking or Removing

Ask the credit card company to temporarily deactivate the card for a short period of time. This will help prevent further fraud.

To continue access to credit, inquire about the procedure to replace your card.

Review Your Account and Charges for Disputes

Check your statements on your account to find any suspicious transactions you may have missed.

You are able to report fraudulent transactions to the card issuer to have them examined and then resolved.

Be Watchful and Monitor Your Credit Report

Make sure you make contact with the credit card issuing company.

Always monitor your credit card account for any unusual or unanticipated activity.

You might want to consider putting up Fraud Alerts or Security Freezes

If the situation is serious it is possible to consider putting in the credit freeze or placing a fraud alert to safeguard your identity from fraud attempts.

Report to Authorities If Required, report to authorities

If you suspect identity theft or fraudulent activity, consider making a report to the Federal Trade Commission (FTC) and then filing a complaint with the local law enforcement agency.

Taking swift action is crucial to minimize potential losses and prevent additional unauthorized transactions. You can reduce the risk of fraud on your credit card and misuse by reporting suspicious activity immediately to your credit card company.

What Qualified Individuals Can Use Credit Card Numbers Through The Blacklist Application?

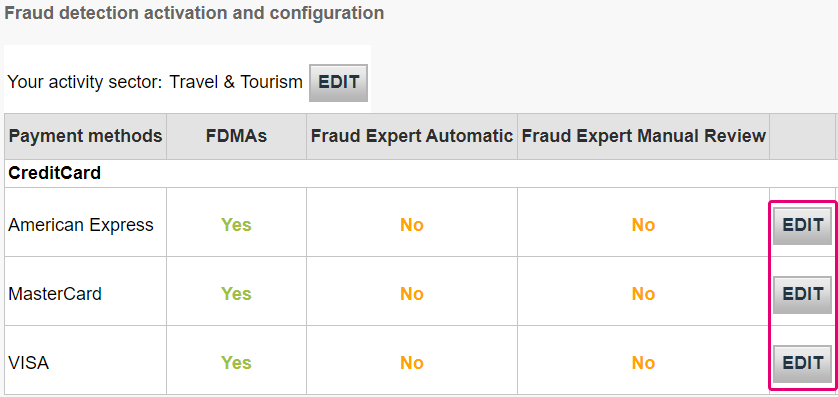

The professionals working for financial institutions or law enforcement agencies as well as cybersecurity firms are typically licensed to verify credit card numbers as well as check for fraud involving credit cards. They are Fraud Analysts- individuals who are trained by banks to detect and investigate fraudulent activities involving credit cards. They use specially designed tools and software to identify patterns, anomalies, and stolen card information.

Cybersecurity Experts- Experts who specialize in cybersecurity, specifically in monitoring and identifying cyber dangers, including compromised credit card information. They prevent data breaches by analysing the data and identifying signs of compromise.

Law Enforcement Officials - Specialized units as well as individuals within law enforcer agencies that investigate financial crimes, including fraud of credit cards. They have databases and resources they can utilize to monitor and analyze fraudulent activity.

Compliance Officers- Professionals who are in charge of ensuring that they comply to the law and regulations applicable to financial transactions. They may supervise processes for identifying suspicious activity that involves credit card.

The authority to validate credit cards against blacklists or databases is controlled by law and requires the appropriate authorization.

The teams and individuals have the ability to utilize special protocols, software and legal procedures in order to confirm the credit card details using blacklists. All while adhering strict privacy and security laws. If you're worried about security concerns regarding your credit card data, it is important to contact an authorized professional or institution. Access or use that is not authorized of credit card "blacklists" can lead to legal implications. Follow the top savastan0 carding for site info.